|

(www.RemnantNewspaper.com)

The country has just passed through a long debate to

reach a doubtful end. Indeed, it is not really an end at

all, but a mere postponement of the fight, a fight that

will last through the next elections at least. Hence, we

will spend the next year and a half witnessing a debate

over debts. All other business of government will be

pushed to the margin. Some will argue that this is

necessary, because the debt—and the debt limit—is the

most pressing business of government, an issue that

determines all other issues. Further, they will point to

the turmoil in Greece, and the coming turmoil in other

Eurozone countries, with the “bond vigilantes” demanding

high interest rates to purchase their risky debts, and

imposing stiff austerity measures on these countries.

And finally, they will make an analogy to household and

business budgets, where people are expected to “live

within their means.” But most of all, these debates are

driven by a belief that the government is too big and

taxes too high, and that shrinking both will lead to the

prosperity that has eluded us for the last three years

at least. (www.RemnantNewspaper.com)

The country has just passed through a long debate to

reach a doubtful end. Indeed, it is not really an end at

all, but a mere postponement of the fight, a fight that

will last through the next elections at least. Hence, we

will spend the next year and a half witnessing a debate

over debts. All other business of government will be

pushed to the margin. Some will argue that this is

necessary, because the debt—and the debt limit—is the

most pressing business of government, an issue that

determines all other issues. Further, they will point to

the turmoil in Greece, and the coming turmoil in other

Eurozone countries, with the “bond vigilantes” demanding

high interest rates to purchase their risky debts, and

imposing stiff austerity measures on these countries.

And finally, they will make an analogy to household and

business budgets, where people are expected to “live

within their means.” But most of all, these debates are

driven by a belief that the government is too big and

taxes too high, and that shrinking both will lead to the

prosperity that has eluded us for the last three years

at least.

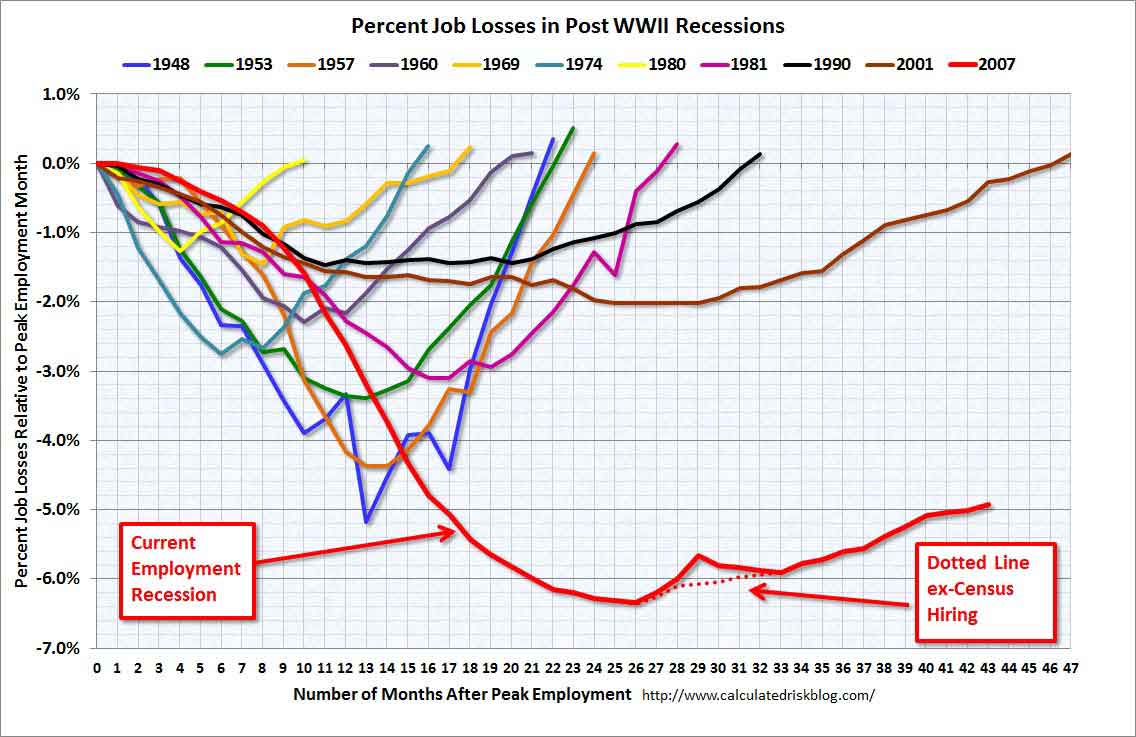

But let me suggest that the debate is wrong-headed and

deals with the wrong issues, issues that have little

effect on our real problems. What really bothers people

when they get out of bed in the morning is not the

federal debt, but the uncertainty over their jobs,

presuming they have them. But 15 million people don't

have jobs, and millions more are underemployed, with

part-time work or work below their skill levels. And

even among the employed, there is great fear, since

their bosses have demonstrated to them, over and over

again, that they are disposable commodities, to be

instantly cast off if the Chinese workers make a better

offer, or if the shareholders demand a higher return.

Over and over again, they are reminded that they are but

bit players in the economy, cogs in a vast

socio-economic machine over which they have little

control and no voice. And they see clearly, far more

clearly than their leaders, that there is little

likelihood that the economy can provide the missing jobs

or return to them their lost security.

“But surely,” you say, “the debts affect our jobs?” That

is correct, but you would be dealing with the wrong

debt. The problem with jobs shows up in the trade

deficit, the money we actually owe foreigners for the

goods we import, but don't earn enough to pay for. This

should be the focus of the discussion. This is the real

accounting of real jobs lost and real debts incurred;

yet one never hears about it.

But you again you might say, “Won't the federal debt

lead to the same problems as we see in Greece?” The

answer is that we won't have the Greek problem because

we don't have the Greek debt. Their debt is owed mostly

to foreigners (57%) and payable in what is, in effect, a

foreign currency, the Euro. The hard lesson that the

Greeks are learning is that the loss of one's own

currency is the loss of one's own sovereignty. The

Greeks owe “hard” money to hard men, men willing to

extract hard concessions and high interest rates from

people who were not involved in the debacle.

Our debt is not comparable. In the first place, only

about 31% is owned to foreigners, and they are not about

to “foreclose.” In fact, they are very comfortable with

American government bonds, and are willing to buy more

of them at low interest rates. Throughout this

discussion, and despite predictions of Greek-level

interest rates, bond yields went down, not up.

The 10-year Treasury is yielding a measly 2.56% as I

write this, which indicates that the bond market, unlike

our own “leaders,” have very few worries about our

debts.

The second difference is that roughly 40% of our “debt”

is really just inter-fund transfers, that is, money one

department of government owes another; the government is

the biggest holder of its own debt. The Social Security

and Medicare funds hold $2.7 trillion. There are some

problems there, most immediately with the Medicare fund,

but that has different causes and different cures.

Another $1.7 trillion is held by the Federal Reserve

System. This is the oddest part of the “debt” since the

money does not represent funds that anyone loaned the

government; rather they are just “credits” that the

Federal Reserve “printed” out of thin air, or rather,

pressed a few buttons on a computer. For all I know,

Bernanke has an app for that on his iPad. The Treasury

pays interest on these funds, but because the Government

owns the Federal Reserve System (but not the 12 Federal

Reserve Banks—it's complicated) the monies earned come

back to the Treasury. So this isn't really a “debt” at

all, but a series of accounting entries. As Senator Rand

Paul pointed out, the Federal Reserve could simply tear

these “debts” up and instantly reduce the deficit and

avert the phony “crisis.”

Since foreigners buy our debt in our currency, they are

unlikely to “get tough” with us as they have with

Greece. “Want your money back? Fine, we'll print you

some more.” Maybe Bernanke has an app for that as well.

It might have mildly inflationary results, or it might

simply force other countries to buy more goods here and

thus increase employment. In any case, it is unlikely to

happen. But they don't want it back, and seem quite

happy with their paper-thin interest rates.

As for the analogy with household budgets, this is

accurate, but I know of few people who buy their homes

or cars in cash, or who don't depend on credit to send

their children to college, or even to make it through to

payday with their credit cards. To equate “living within

your means” to “buying everything in cash” establishes a

standard that few of us would meet.

As for the effect of the deficit on jobs, we cannot cut

billions and billions of dollars without cutting

thousands and thousands of jobs. And the more jobs we

cut, the greater the impact. Greater burdens will be

placed on both the federal and the state governments, as

people apply for unemployment benefits, lose their

health care, and require greater use of public and

private social services. And layoffs beget layoffs; with

fewer customers to buy goods, producers require fewer

workers to produce them. The plain and unavoidable fact

is that our late-stage capitalism is incapable of

employing all of our citizens. In seeking maximum profit

alone, rather than reasonable profit and a healthy

economy, the capitalist gets his wish; the stock market

soars while the nation tanks. We are becoming a

two-track society, with one (small) group doing very

well, while the rest sink into greater insecurity.

Indeed, the top 10% commanded nearly 50% of the nation's

income in 2007, a level not seen since 1929. The Great

Depression reduced the disparity, so that the top share

sank to about 32%, and stayed there until the early

1980's; this was the period of the “The Great

Compression” when the United States became one of the

the most egalitarian—and productive—societies in

history. But in the current recession, the percentage of

income going to the top actually increased; instead of a

compression, we got an increasingly widening gap.

Somebody got a bailout, but it wasn't you and me. The

situation is worse than ever, and ripe for a

“double-dip” recession.

In other words, Obama has failed to address the

underlying problem, and the Republicans are talking

about the wrong issue; the President elected for his

eloquence has remained silent. But it is somewhat

amazing, to me at least, that Obama is in this position.

This debate began last December, after the Republican

“shellacking” of the President's party. Nevertheless,

the President still held all the cards; the Bush tax

cuts were about to expire by law and the Republicans,

even with their new majority in the House, did not have

the votes to override a Presidential veto. If he was

going to trade the scheduled increase away, he might at

least have got something substantial in return, like an

agreement to raise the debt ceiling and avoid this

meaningless and debilitating fight. Instead, he merely

got the Republicans to agree to what they had to do

anyway: pass a budget, which they only did in drabs and

dribbles.

All this was in line with the Republican belief that the

simple solution (to every problem) is to reduce taxes.

But if this was going to work, it would have worked

already. The Bush tax cuts reduced taxes to their lowest

level since the Second World War; we should therefore be

in the midst of a boom. But the only “boom” we

experienced was the housing bubble, fueled mainly by

cheap credit supplied by the Fed, and financial

manipulation ignored by the regulators. During the

bubble years, the only real growth, apart from

construction, was in health care, education, and

finance. The rest of the economy was actually shrinking,

especially manufacturing.

As for the budget, it is under the control of Congress,

which has the exclusive power to tax and spend. But the

Republicans do not trust the Congress, even—or

especially—when they control it. They know full well

that the bulk of the debt that has been built up since

the Second World War occurred under Republican

administrations. Hence, they want some sort of

“automatic” mechanism. But this never works, because

there must always be a way to make exceptions, and

pretty soon every expenditure becomes “exceptional.”

This is what happened to the so-called “paygo” rules

(“pay as you go”) of the 90's. In order to make real

spending cuts, the Republicans will have to muster the

political will to take difficult stands. The “Starve the

Beast” strategy of relying on tax cuts alone to force

the government to shrink—a strategy in place since the

Reagan administration—hasn't worked, because the beast

is just as happy to fatten himself on credit as he is on

cash. Speaker of the House Boehner may weep hot tears

over the debt, but it is a debt composed of the annual

deficits that he himself voted for, year after year.

The Republicans played poker with Obama again in the

most recent deal, and again Obama folded. All he had to

do was offer some reasonable plan, and then take the

case to the public. He could then present the GOP with

the option of accepting it (with cosmetic modifications

of course, for the sake of “bipartisanship”) or shutting

down the government. The Republicans know, from the last

time they tried that, that it doesn't sit well with the

public, and they would have taken the deal, Tea-Partiers

notwithstanding. But Obama had no plan to present, and

therefore nothing to say; once again he folded his hand,

and accepted the Republican plan.

That plan raises the debt ceiling in stages, giving

Obama many more opportunities to fold; the Republicans

have decided that they like this game, and given the

quality of their opponent, who can blame them?

Well, we all can. The “plan” guarantees that we will be

talking of nothing else, and certainly nothing else

important. This despite Obama's promise to “pivot”

towards jobs. This would be the eighth such “pivot” of

his administration, each one more pitiful than the last.

The current jobs plan involves changes to the patent

laws, continuing cuts in payroll taxes, new free trade

agreements, vague promises to improve education, and an

“infrastructure bank.” But trade agreements are part of

the problem not the solution, and there are no funds for

the infrastructure. That leaves the President—and the

nation—with nothing. Hence it is likely that we will see

a double-dip recession before the Spring and perhaps

even before the New Year. And it won't really be a

“double-dip”; it will just be a continuation—and

deepening—of the recession that started at the end of

2007, the one which he promised to heal.

The candidate of “hope and change” turns out to be

hidebound and hopeless. In truth, he needs some of that

Sarah Palin, “Don't retreat, reload” spirit. But he

seems to be out of ammo, and has very little

understanding of the situation. Pivot he may, time and

again, to jobs question, but he seems to have little to

say after each pirouette. This is partially a problem of

a young man who has little experience in government.

Even Sarah, with her half-terms as mayor, commissioner,

and governor, has more administrative experience than

the President.

What needs to be done is to renegotiate our trade deals

and let the dollar find its true level. For any country

with whom we are running an immodest trade deficit, they

must be required to accept more of our goods or face

punitive tariffs until the balance is redressed. This

would encourage local manufacturing, and without making

things, no nation can become prosperous, and certainly

not prosperous enough to pay its debts. Further, the

foreign profits of American firms must be taxed. As it

is, we are actually subsidizing the outsourcing of

American jobs. Some would complain that this would lead

to a “trade war,” but the truth of the matter is that we

are already in such a war, and we are losing badly.

Televised poker tournaments have become very popular.

I've never been attracted to them myself, but I would be

willing to chance it if I could be guaranteed that

Barack Obama would be my opponent. I'm pretty sure that

even if he is dealt all the aces, I can get him to fold

against my pair of deuces. |